Why procrastinating may cost you dearly

We all lead busy lives, and it’s easy for long-term planning to be pushed aside by day-to-day priorities. But when it comes to your financial future, the cost of delay can be significant.

As an Independent Financial Adviser, one of the most common things I hear is: “I wish I’d started this sooner.” This article explains why getting a head start—particularly with retirement planning—can make a big difference when it comes to achieving your lifestyle goals, and how compound growth rewards those who act early.

I wish I’d started this sooner

Mid-year reality check

With the longest day behind us, we’ve passed the halfway mark of the year—a natural time to reflect on progress and revisit the tasks still sitting on the back burner. If financial planning is one of them, now is a great time to take action.

The value of starting early

Early in our careers, most of us are focused on the here and now: managing everyday expenses, enjoying financial independence, and maybe even making a few unnecessary purchases. But when it comes to investing or saving for retirement, the earlier you start, the better the outcome.

One of the most powerful factors in financial planning is compound growth—where your investment earnings generate their own returns over time. The longer your money is invested, the greater the benefit.

Albert Einstein famously referred to compound interest as the eighth wonder of the world, a sentiment echoed by legendary investor Warren Buffett.

Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t, pays it. — Albert Einstein

Compounding is a powerful financial force that can create significant wealth over time — not through luck, but through patience, discipline, and time in the market.

Let’s look at the power of starting early

The power of compounding has a major impact on regular savings or regular contributions to a pension.

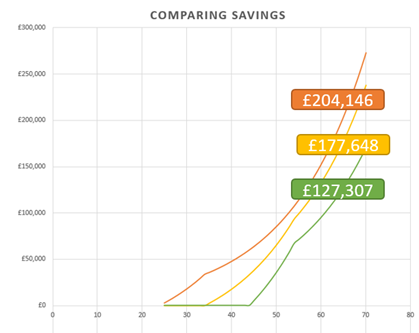

To illustrate my point, I have compared three savers/investors and assumed a 6% annual return rate.

In orange, we have a 25-year-old saving £2,400 per year for 10 years. A total of £24,000 invested.

In yellow, we have a 35-year-old saving £2,400 per year for 20 years. A total of £48,000 invested.

In green, we have a 45-year-old saving £4,800 per year for 10 years. A total of £48,000 invested.

The values shown are at age 65.

By starting 10 years earlier, our 25-year-old saver has the biggest retirement pot come age 65.

The result is impressive when you consider that, in total they have contributed/invested half as much as our 35- and 45-year-old.

In fact, our 45 year old has had to contribute twice as much per year as the 25 year old to be left with a pot not much more than half the size.

The additional annual expense for our 45 year old also limits their discretionary spending, often in the years where family holidays and socialising are high on the agenda.

The cost of waiting

Starting later often means playing catch-up—requiring higher annual contributions to reach similar outcomes. It also reduces flexibility in later life, as discretionary spending competes with increased savings goals. Delaying financial planning may seem harmless in the moment, but the long-term impact can be significant.

Take control of your financial future

Whether you’re just starting out or reviewing your current plans, it’s always worth taking the time to consider how your retirement and long-term savings are shaping up. A well-structured plan can make a big difference over time—particularly when it comes to making the most of compound growth and tax-efficient solutions.

If you have any questions, please don’t hesitate to get in touch.