The dollar dilemma: combatting hidden risks

Despite ongoing political uncertainty and a sharp decline in the value of the dollar, US equities have continued their upward trajectory, hitting new all-time highs. However, some multi-asset investment strategies that adopt a market-cap weighted investment approach, where they allocate to stocks based on their size in an index, may have become exposed to elevated risks.

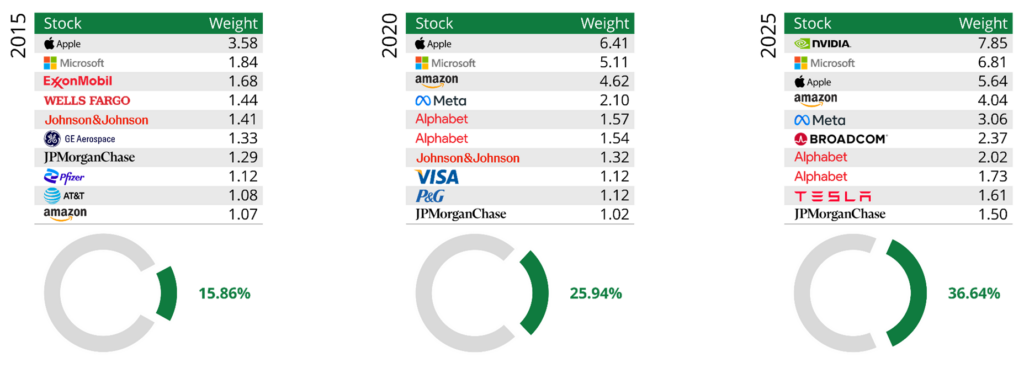

The strong performance of US equities in recent years has been a major driver of global equity returns. On a market-cap weighted basis, where the size (market cap) of the stock drives it’s weight in the index, US equities now represent 66% of the global equity index (as at 31 July 2025). Within the US index, the ‘Magnificent Seven’ (the name given to the tech giants of Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia, and Tesla) account for more than one-third of the index – a testament to their extraordinary growth.

It is also interesting to observe that in 2015, the top ten holdings in the index were diversified across various sectors and industries, whereas it is now much more concentrated on tech stocks riding the artificial intelligence wave. This surge has been nothing short of remarkable, reshaping the global equity landscape and significantly amplifying returns for investors following a market-cap weighted investment approach.

Top 10 stocks by weight of the US equity index

Source: Quilter and FactSet as at 31 July 2025. Top 10 stocks of the MSCI USA Index as at 31 July 2015, 31 July 2020, and 31 July 2025.

Elevated valuations

However, while valuations, the market’s view on how much companies are worth, among the ‘Magnificent Seven’ are high compared to historic levels, the continued stream of strong returns has reinforced the belief that their growth story will simply run on and on. Yet, this story risks overlooking concerns that could challenge future performance.

Let’s think about this for a moment. We know US equities now account for a staggering 66% of the global equity index – that is up from 58% five years ago and 52% a decade ago. So, what will that figure be in ten years? Even if there is no further growth – that 66% figure represents a serious lack of diversification in portfolios that follow a market-cap weighted investment approach with the high allocation to one single currency, the US dollar, adding further risk. Surely, investment decisions should be guided by a more forward-looking and rational assessment of future market dynamics, with greater attention paid to other regions and sources of diversified growth?

The unintended consequence of currency moves

As noted above, the US equity index has just reached another all-time high. From the start of the year to 31 July, it has delivered a total return of 8.8% in US dollar terms. However, for sterling-based investors, the return over the same period has been only 2.9%. This is because when a sterling-based investor holds a US dollar investment, and the US dollar falls compared to sterling, the realised return from the investment will decrease even when the underlying asset performs strongly.

While the reverse can also be true during periods of dollar strength, this dynamic highlights the hidden risks that can arise from concentrated exposure to a single region and currency and further underscores the importance of diversification.

The importance of risk targeting

However, it is not just about geographic and currency exposure – it is about ensuring the portfolio remains aligned with the risk appetite of the investor. By continuously adapting to evolving market conditions and future expectations, risk-targeted strategies can offer a more robust framework for managing uncertainty and delivering consistent outcomes. So, the theory is sound, but let’s consider a real-life example by looking at the Quilter WealthSelect Managed Active 5 Portfolio and considering its risk-targeted objective.

The asset allocation approach taken by the WealthSelect portfolio managers is intentionally dynamic. They rebalance the portfolio quarterly but have the flexibility to undertake ad hoc tactical rebalances at their discretion to take advantage of market opportunities or manage risk. The rebalances also involve reviewing the return expectations for various asset classes, the correlations between returns (how likely it is they will move in the same way if markets go up or down), and the expected risk to ensure an optimal strategic asset allocation remains in place over the long term. This forward-looking approach allows the portfolio management team to implement their investment conviction, whilst also keeping a sharp focus on the risk profile over both the short and long term.

By consistently aligning the portfolio with the risk appetite of the investor and maintaining the flexibility to evolve asset and regional equity market allocation as market conditions shift, WealthSelect can provide a resilient framework for navigating future uncertainty. This dynamic approach helps ensure portfolios remain appropriately positioned, even as markets become more volatile or unpredictable.

Meeting future challenges

So, strategies that rely on a market-cap weighted investment approach to regional equity allocation have undoubtedly benefitted from elevated exposure to US equities in recent years. However, with markets encountering increased uncertainty, the need to prepare for what lies ahead has never been greater. In this context, risk-targeted solutions – with their ability to adapt asset allocation in a controlled and forward-looking manner – may be best positioned to deliver resilient outcomes in an evolving investment landscape.

Past performance is not a guide to future performance and may not be repeated. All data sourced from Quilter and Factset as at 31 July 2025. The global equity index is represented by the MSCI All Country World Index and the US equity index by the MSCI USA Index.

Questions?

If you have any questions, please speak to your Independent Financial Adviser

Important Information

This document is a marketing communication and should not be considered independent investment research. Any financial instruments or securities referred to are not subject to restrictions on dealing before this communication is distributed. References to specific securities or instruments do not constitute personal recommendations and should not be treated as an offer or solicitation to buy or sell.

This material does not constitute tax, legal, or accounting advice and should not be relied upon for such purposes. Quilter plc does not provide tax, legal, or accounting advice, and we strongly recommend you consult your own professional advisers before undertaking any transaction.

For full corporate and regulatory regulations, please click here.