The Insurance landscape is currently in a hard market cycle across a number of insurance classes. Insurers are tightening up their criteria for coverage and it’s possible that businesses will not receive the levels of coverage previously secured, with premium increases and lengthy renewal processes all being likely.

Peter O’Donnell, Associate Director at MAC Group, has a few words on the current state of the market and guidance on how businesses can best prepare.

“In 2019 we saw a significant tightening of conditions in the financial institutions insurance market. Large claims combined with less insurers reduces the liquidity of the market and price increases until more competing insurers emerge. Our expectation is that conditions should continue as they are until at least the final quarter of 2020.

The hard market cycle means that businesses need to be prepared for the renewal process to be more challenging than usual, don’t assume that it will be secured easily, or that your new policy will have the same breadth or coverage without a significant rise in the premium.

Whilst a number of market classes are being affected, Professional Indemnity (PI) and Directors’ and Officers’ (D&O) will see difficult trading conditions continue for much of 2020. Underwriters are being more selective and for PI, capacity has halved in the last 18 months.

As a broker with international capability, we will be collaborating with our international insurers more for our large or complex schemes as well as utilising our market leverage to continue the provision of enhanced and bespoke insurance policies

Here are some of the actions you can take to ensure you receive the best available terms from the market:

- Work with a broker that understands what you do, is well resourced and can leverage the insurance market regardless of which part of the cycle it is in.

- Start your renewal process early with a clear strategy for what you want to achieve and contingent plans in place should the need arise.

- Devise a disclosure plan in conjunction with your broker that works best for your risk and allows differentiation from the market norm.

- Ensure your broker influences the wording of the Terms and Conditions to protect you and not the insurer”.

- Be cautious about accepting premium relief in consideration of coverage restrictions, it is unlikely to provide long term value.

MAC Commercial (a part of MAC Group) is an all-inclusive insurance broking service for corporate and private clients. Our knowledgeable team develop long-term and personal relationships with each client which means we can provide a truly bespoke service. If you are looking for a competitive insurance quote, or if you need some help in identifying all potential areas of risk in specialist circumstances, we will be able to tailor a solution suitable for you.

Produced in association with MAC Group & Arthur J. Gallagher

01624 639450 [email protected] www.macgroup.im

MAC Commercial & Professional Risk Limited is Registered with the Isle of Man Financial Services Authority as an insurance intermediary in respect of General Business. Registration Number: 118815C

Cyber underinsurance

Hackers Don’t Sleep. Neither Should Your Insurance By Craig Gawne, Senior Account ExecutiveIn the risk landscape of 2025, cyber underinsurance is emerging as a pressing strategic threat. At MAC Insurance Brokers we see it as a critical blind spot,...

Quilter update | September 2025

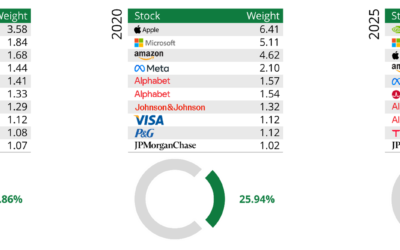

The dollar dilemma: combatting hidden risks Despite ongoing political uncertainty and a sharp decline in the value of the dollar, US equities have continued their upward trajectory, hitting new all-time highs. However, some multi-asset investment...

MAC Golf Day 2025

MAC Group is proud to announce that an incredible £14,500 was raised for Forget Me Not at this year’s MAC Golf Day.

Quilter Cheviot | Investment review of Q2 and H1 2025

Olly Smith, Investment Manager summarises what has happened in the second quarter of 2025, and the impact of Trump’s tariffs.

Procrastinating may cost you dearly

Why procrastinating may cost you dearly By Natalie Bush, Senior Independent Financial Adviser (IFA)We all lead busy lives, and it’s easy for long-term planning to be pushed aside by day-to-day priorities. But when it comes to your financial future,...

MAC Group Sponsors IOM Swim Team

MAC Group is proud to have supported the Isle of Man Swim Team as Silver Sponsor for the 2025 Island Games in Orkney.

Insurance market update Summer 2025

Ann Zachorecki highlights rising costs, regulation, and talent gaps shaping the UK and Isle of Man insurance landscape.

Saving for university?

Senior IFA, John Condon explores the help available for Manx students going to university and the financial impact on families.

Colin Moore Joins MAC Financial

MAC Financial is pleased to announce the appointment of Colin Moore PhD, Chartered FCSI, as a Senior Independent Financial Adviser.