Every day seems to bring more news about challenges in the economy with negative impacts on financial markets. What does this mean for your pensions and investments and what should you do about it?

What’s happening?

Markets are currently reacting to multiple challenges:

- The aftermath of the pandemic

- The impact of the Ukraine war

- Supply chain constraints

- Rising inflation

- Rising interest rates

- Changes in Government – more than once!

All of this has resulted in increased volatility and falling valuations. But is this something to worry about? As always, that depends on your viewpoint. The more of a short-term view that you have, the more important it will be.

Long-term thinking

Taking the long view can help put short term movements in perspective. Moreover, if you are investing regularly through your pension/investment then you will benefit from pound cost averaging – you will be buying more units for your money each month. This means that when the markets recover, and the units rise in value, your pension and investment value will also rise.

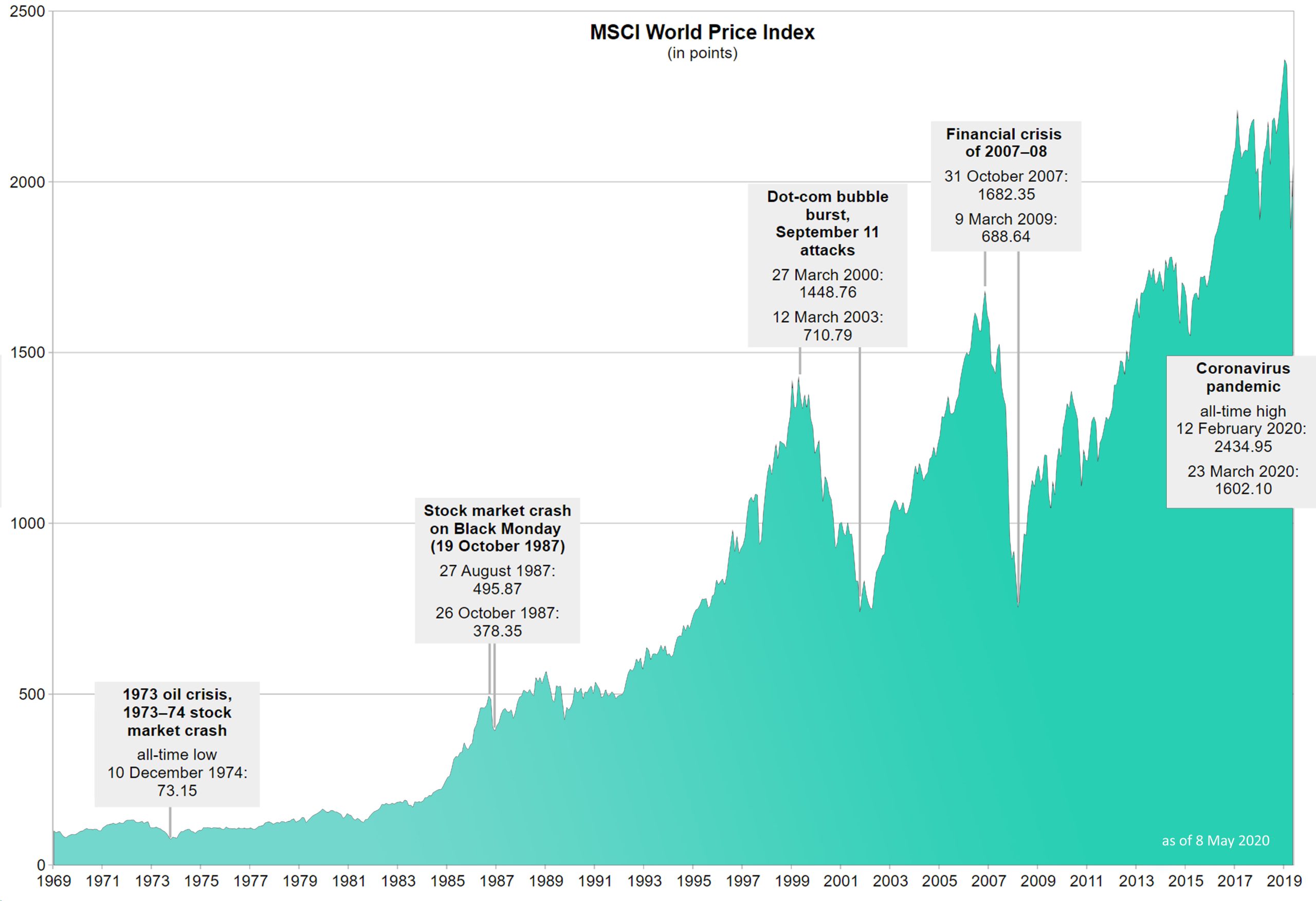

Whilst we can’t predict what will happen in the future, it is helpful to look at how markets have recovered in the past after downturns. The graph below illustrates the history of market fall and recovery over the years.

Short-term thinking

It is of course very worrying to watch your current pension and investment values fall and you may be considering changing how your funds are invested or even thinking about cashing them all in.

But please, pause and consider your position: selling now, when the markets have already fallen will mean that any recent losses are secured. It is important to remember your pension or investments are for the longer term. This may help you feel more able to weather the more volatile times. Research shows that those who stay invested over the long run in a well-diversified set of funds will generally do better than those trying to time the market.

What should you do now?

Firstly, consider your individual circumstances. You might be some way from retirement, about to access your pension or investment for the first time, or already drawing an income from your pension/investment plan. But the principle of ‘don’t panic’ applies in each of these scenarios. The following articles from Vanguard and Aviva may be helpful in considering your position further

The dos and don’ts of investing in a downturn

Retired or retiring soon and worried about falling markets?

How to keep calm when stock markets fluctuate – Aviva

Secondly, it is best not to make any sudden decisions but speak to your financial adviser first.

COVID-19 Update

Good morning everyone and a happy new year to you!The Isle of Man has been doing a fantastic job of keeping our community safe - so let's keep it up! Following the media release regarding the recent positive COVID-19 cases, if you, or any of your...

MAC Group acquires the business of Island Financial Solutions Limited

MAC Financial Ltd (part of the MAC Group) has announced a further expansion with the acquisition of the clients of Island Financial Solutions Limited (IFS), an independent financial advisor business based on Prospect Hill in Douglas. All IFS...

Anna Beth

There's quite a lot of big news here at MAC that of course is beginning to circulate in the reliable Isle of Man ways, but we're very excited about sharing it with you properly ourselves soon! In the meantime, we're pleased to introduce Anna Beth,...

COVID-19 Wellbeing Hub and Charity Donations

MAC Group staff donate part of their salary to support the NHS on the Island and MAC announces imminent launch of Covid-19 Wellbeing Hub which will be free for individuals and businesses on island to access. The challenges to the community and...

MAC Group office is closed, but the business is very much open!

Following yesterday's announcement from the Isle of Man Government, we have made the decision to close the MAC Office until further notice. We have no concerns regarding our ability to continue to provide service to our customers. To minimise any...

Prepare for a successful renewal on your commercial insurance

The Insurance landscape is currently in a hard market cycle across a number of insurance classes. Insurers are tightening up their criteria for coverage and it’s possible that businesses will not receive the levels of coverage previously secured,...

MAC Group Delivers Transparency in a Complex World

The financial world is ever changing, fast-paced and can be easily confusing for those that don't live it on a daily basis, so over the coming few months we are running a campaign delivering education, guidance and support to those that rely on...

The Isle of Man Ladies Cycle Team Update

We support and sponsor a range of activity based events and activities on the Isle of Man, and we're delighted to share this recent update from our favourite ladies cycling team! The best part is that the number and ability of cyclists is growing,...

MAC IOM Business Golf Championships 2019

It is with great excitement that we announce the inaugural MAC IOM BUSINESS GOLF CHAMPIONSHIP to be held at Castletown Golf Links on Thursday 18 July 2019. As title sponsor, MAC Group is thrilled to be associated with this inaugural event This...