MAC Group Investment Update

A perspective on your investments from MAC Group and market providers in response to the Ukraine crisis.Russia’s invasion of Ukraine has caused an unmeasurable human cost and the significant sanctions placed on Russia will have consequences for the global economy. We have kept up to date with updates from our providers and have summarised our thoughts for both private investors and workplace pension members

Private Investors

To summarise our thoughts initially, our opinion is to not panic over your investments. Markets have fallen, but providing your intentions remain to invest on a long term basis, these markets should recover.

The current market turmoil sits on top of an already shaky start to 2022 with rising inflation and the expected rise in interest rates. Whilst the Ukraine crisis has overtaken the previous market concerns.

Quilter Cheviot provides a good background in their latest commentary to the current investment thought process held by the majority:

“Longer term data indicates that markets recover their footing, sometimes quite rapidly, especially as the scope and scale of any fighting becomes clear. If we look to examples such as the Crimean annexation of 2014, investors experienced some volatility, but global equities soon resumed their upward trend as the crisis subsided.”

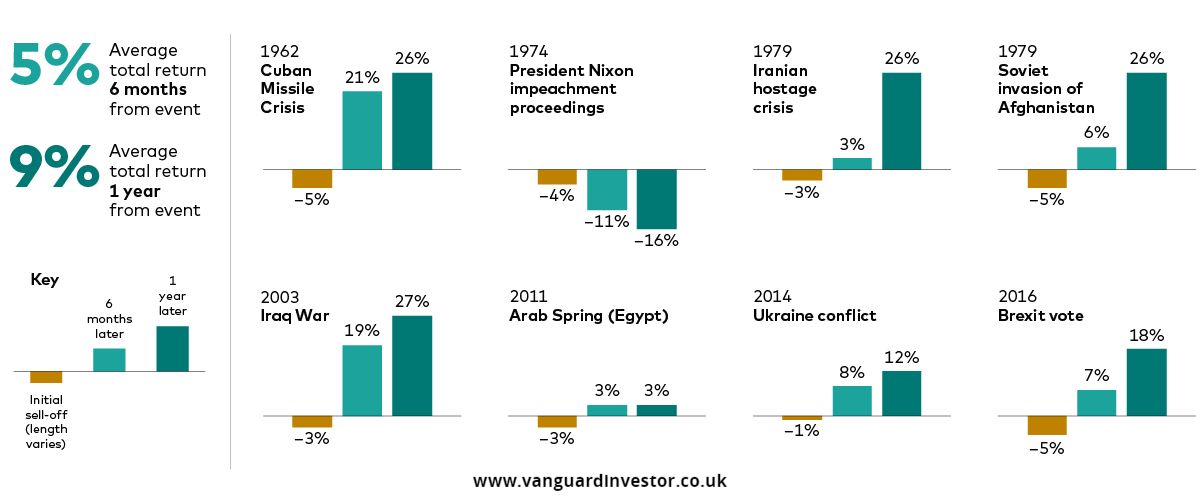

Greg Davies, Chief Investment Officer at Vanguard, agrees with the above sentiment and writes that whilst it is difficult, it is best to resist the urge to act. To offer some perspective, the following graphic has come from studies Vanguard have performed on more than two dozen geopolitical events over the last 60 years.

Quilter has produced a guide for investing through volatile times which has some really useful information.

Workplace Pension Members

Workplace pensions will be affected in the same way as private investments but pension members are not always as experienced in the investment market as many private investors and this can cause greater anxiety for those who notice their pension values falling. The guide provided on the link below gives an excellent guide and video around workplace pension investments in the current climate. We’ve also included two further summaries from Aviva for My Future Focus and Mixed Investments (note this one also includes MFF Consolidation as it’s utilised in the de-risking phase).

Click here to download the guide

Click here to download an update regarding your “My Future Focus” Investments

Click here to download an update regarding your “Mixed Investments”

There is no doubt that this is an uncomfortable time for investors but it is never advisable to sell down to cash in the midst of market turbulence. If your investment horizons are still a long way off, and you do not need any funds in the near term, our opinion stands that you should not make any rash moves.

We hope that this provides some assistance in helping you navigate through this fast changing period. We will continue to monitor the situation carefully and keep in close contact with the providers regarding our clients’ portfolios.

As always, if you need any information clarified or if there is anything further we can help with, please get in touch with us.