Guest opinion from Greg Easton, Resilience Asset Management

It is often said that taking a sustainable approach to investing means sacrificing returns. That is not always the case.

Year-to-date, the Regenerative Growth strategy is up 24.94%, 6.88% ahead of our benchmark, the MSCI All Country World Index. Our outperformance is the green section highlighted above.

The Regenerative Growth strategy is comprised of 55 direct equities invested across five interwoven sustainable themes: Climate Solutions; Biodiversity Leaders; Sustainable Consumption; Sustainable Agriculture; and Sustainable Innovation.

Regenerative Growth Characteristics

Typically, there’s a perception that sustainable portfolios are overly growthy with lots of smaller companies. Again, that’s not the case with Regenerative Growth. 61% of the portfolio is Large-Cap; 25% Mid-Cap; just 13% Small-Cap and 1% in Micro-Cap (more on that later).

Geographically, we are underweight US (42% Vs 65% MSCI ACWI) and whilst we are sector agnostic, we are significantly underweight Technology, Financials and we have no traditional Energy exposure.

The trailing 12-month Price to Equity Ratio is 20.71 compared to 23.16 for the MSCI ACWI. We often get asked if we have a growth or value strategy, we seek sustainable growth at a reasonable price.

The portfolio has a low Beta of 0.69, a Sharpe ratio of 2.12 and generates a yield of 2.06%.

Notably, we have no exposure to the magnificent 7, when Technology and AI stocks do well, we may miss out on some of the frothy upside; however, when there is volatility or a sell-off, we tend to hold up relatively well. This was the case back in February when the Trump Tariff noise started to ramp up prior to ‘Liberation Day’ and again during April when we saw significant volatility intra-month in global equity markets.

The Value and Importance of Correlation

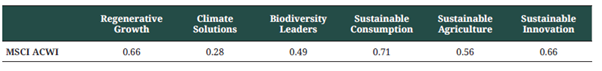

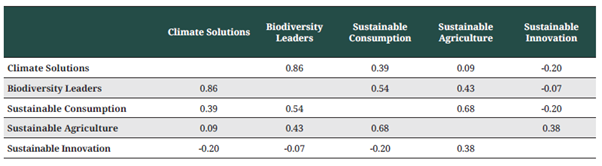

The portfolio exhibits a relatively low correlation to the MSCI ACWI with each theme having different characteristics that enable us to tilt the portfolio to protect and grow capital through volatile market conditions.

When you assess the correlation of each theme to equity markets (and to each other) you can start to see why the Regenerative Growth strategy is an attractive hold alongside more traditional global equity assets.

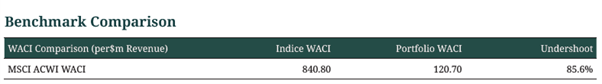

We’re generating comparable returns from equity markets in a very different way and without the toxicity as demonstrated in the 85.6% undershoot in the Weighted Average Carbon Intensity of the portfolio versus the benchmark.

Can you have you cake and eat it?

In May we added Barry Callebaut (BC) when it was trading around CHF825 per share, it’s now trading at CHF1,235 per share.

BC is a relatively unknown company, but you will find it in your kitchen cupboards. BC supplies Cocoa and chocolate products to global food manufacturers – Nestle, Mars, Hershey and Unilever as well as specialist chocolatiers and artisanal users of chocolate.

Being unloved and under-owned made it attractive and BC’s market leadership, global scale combined with their multi-channel, multi-segment resilience and agile strategy were the primary investment drivers for adding BC to the portfolio.

However, to be included in Regenerative Growth each company must meet our sustainable integrity tests, based on our qualitative analysis and the quantitative data we utilise from our partnership with Mainstreet Partners.

From a quantitative perspective BC is rated 4.02/5.00 (very positive) on an overall ESG rating by Mainstreet with a 4.25/5.00 Environmental rating. BC also demonstrates that it is positively aligned with the UN Sustainability Goals, particularly important for us are SDG 14 (Life below Water) and SDG 15 (Life on Land) as this is where may agricultural businesses are negatively aligned.

Within the consumer staples sector the key risks areas from an environmental perspective are around products, the production process and supply chain, BC rates highly in all 3. On the social side an assessment of their human labour rights and community responsibility is also positive.

However, sustainability numbers need to be tested on both the environmental and social aspects. When you assess BC’s sustainability reports the story becomes real.

In 2016 BC launched Forever Chocolate, built on four pillars of prospering farmers, human rights, thriving nature and sustainable ingredients. In the 9 years since launching the initiative they have lifted 557,739 cocoa farmers in their supply chain out of poverty, they have mapped over 1.5m cocoa farms setting a new benchmark for transparency and accountability, launched an assisted natural regeneration project covering 1,200 hectares and 600 farmers, and increased carbon removals by 457,592 tCO2e through the expansion of their agroforestry approach.

So, can you have your sustainable cake and eat it? Yes, you can.

Hidden Gems

We believe that it’s important for investors to understand and feel connected to the assets in their portfolios, each of the 55 current holdings in Regenerative Growth have their own unique story and a resilient rationale for investment, it is important to note that there are no perfectly sustainable companies in the world, like humans they all have their flaws. What we can do is assess businesses thoroughly to determine whether they are making a positive impact on the environment and society, our quantitative and qualitative processes enable us to do that with a high degree of sustainable integrity.

I’d like to spend more time highlighting some of our holdings, the micro-cap company I mentioned earlier – New Zealand Rural Land (+20.56% YTD and a yield of 4.25%) is a hidden gem of an asset giving exposure to 42,480 of sustainably managed farmland in one of the most stable jurisdictions in the world; Acciona (renewables), BorgWarner (sustainable mobility), Boliden (sustainable metal production), Befesa (circular economy), Brambles (sustainable logistics), Ibedrola (renewables), Origin Enterprises (agri-tech), Ormat Technologies (geo-thermal) have all delivered returns of 20-30%+ in 2025 whilst clearly demonstrating sustainable leadership in their respective sectors.

How can you access Regenerative Growth?

Through MAC Financial Limited you can appoint Resilience as discretionary manager, the Regenerative Growth strategy can be managed as a segregated direct equity mandate. Alternatively, the strategy is now available as a fund that you can buy on an execution only or advisory basis.

As a starting point, you are welcome to assess your sustainability preferences using our complimentary online questionnaire: Resilience Questionnaire

More information: