We all like to think it won’t happen to us – that we’re too savvy to fall for a scam.

But the truth is, fraudsters are becoming increasingly sophisticated, and none of us are immune. With the festive season approaching and more of us shopping online, it’s especially important to be cautious about where we enter our card details.

TSB’s analysis of its fraud data indicated that purchase scams accounted for 63% of bank transfer fraud cases reported between January and September 2025 by its customers – an increase of 52% on the same period last year.

To help keep you safe this Christmas and beyond, Natalie Bush, one of our Senior Independent Financial Advisers, has prepared six key tips to help you protect yourself from financial scams.

Tip 1: Use strong passwords

These days, almost everything requires a password – and over time, those passwords have had to become more sophisticated to meet ever-stricter security criteria.

But are your passwords strong enough? Following the recent heist at The Louvre, investigations into their security showed a number of historic failings. Unbelievably, a previous password to access the iconic museum’s video surveillance systems was simply ‘Louvre’.

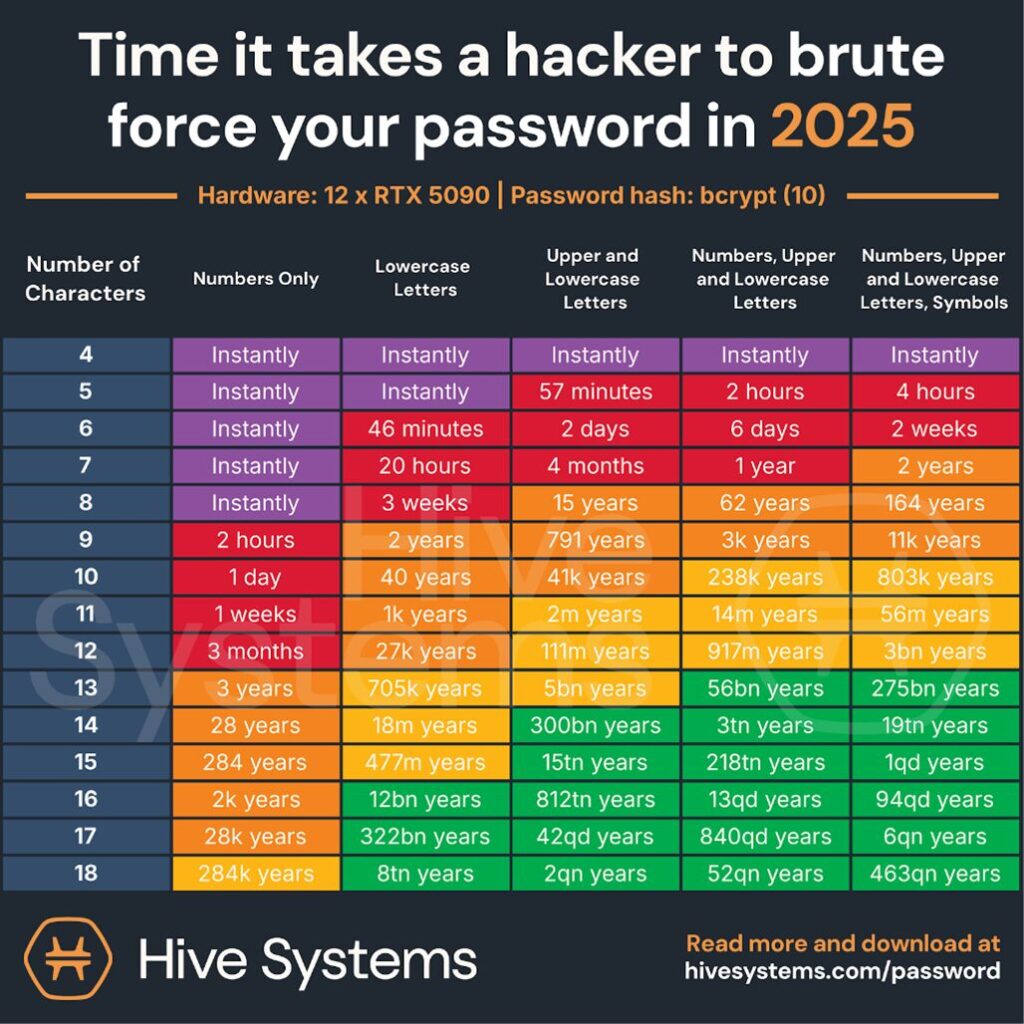

The chart below from Hive Systems shows how long it could take a hacker to crack your password. If you spot your password strength in the last column, it might be time to rethink your approach – and make sure you’re not guilty of using an obvious or easy-to-guess password.

If you’ve got seven minutes to spare, watch this clip from Michael McIntyre – if it sounds scarily familiar, it might just be the reminder you need to update your passwords!

Tip 2: Be email alert

We may no longer be as easily fooled by emails from so-called royalty or lottery winners promising millions of dollars. But email scams have become far more sophisticated and convincing, and it’s easier than ever to get caught out.

Adding a local touch can make these scams even harder to spot, and it’s not just big companies being targeted. Recently, our own regulator, the Financial Services Authority, Douglas-based Conister Bank, and even No Worries Doggy Homestay had their websites cloned – with customers defrauded of their deposit payments.

In just the last two weeks, I’ve received fake emails from Evri, Royal Mail, and TV Licensing asking for login or payment details – none of which were genuine. Some phishing emails are easy to spot, they’re full of typos or sent from strange addresses that clearly don’t match the company name. Others, however, can look completely legitimate.

Remember: never follow links in suspicious emails. If you’re concerned about a recent transaction, always log in directly through the official website. And do your bit to protect others, please forward any suspicious emails to SERS@ocsia.im, the Island’s Suspicious Email Reporting Service.

Tip 3: Use secure portals

Emails can be intercepted – think of an email like a postcard: anyone could read it along the way. If you include personal or financial information in an email, you could be giving cybercriminals everything they need to steal from you or even clone your identity.

That’s why we use our ISO 27001-accredited portal MAC Financial Personal Finance Portal. It allows you to safely share and access documents with our team without the risks associated with sending emails.

Before hitting send, you should think twice before sending important information via email – what if this information ‘postcard’ was read along the way?

Tip 4: Vet your phone calls

Our habits have changed – we now rely far more on online shopping than the high street, and scammers are well aware of it.

Never give out personal or financial details over the phone. If you’re unsure, hang up and call the company back using their official, published contact number.

One of the benefits of working with a financial planner is that we can act as the main point of contact for your financial providers, adding an extra layer of security and peace of mind.

Tip 5: If it sounds too good to be true, it almost certainly is….

It’s a simple statement, but one worth repeating: there’s no such thing as a get-rich-quick scheme. If there were, we’d all be rich by now!

A couple of months ago, the UK Regulator (FCA) issued a warning about high-risk investment schemes offered by unregulated firms. The UK Finance’s Annual Fraud Report 2024, showed that consumers lost £1.17 billion to all types of fraud last year, including over £450m in bank transfer scams.

Closer to home, the Isle of Man Cyber Security Centre reported just under £1.3 million lost to investment scams in 2024. This forms part of a total of £2,240,478 lost to cybercrime on the Island – and that’s only what’s been reported. The actual figure is likely significantly higher.

Using a regulated financial planner and trusted pension or investment products gives you added protection. As financial planners, we have the expertise to identify what works — and what will help you achieve your financial goals. There are no shortcuts.

For more guidance, take a look at our regulator’s guide: How to spot a scam

Tip 6: Be wary of social media and celebrity endorsements

The FCA has issued 38 alerts against social media accounts run by so-called ‘finfluencers.’

Scammers are increasingly targeting young people, with 62% of 18–29-year-olds following finfluencers. Initially, 20 fin-fluencers were interviewed under caution for illegally promoting financial products. Recently, the first three appeared before Westminster Magistrates’ Court, charged with communicating an invitation to engage in investment activity, contrary to Section 21(1) of the Financial Services and Markets Act 2000.

Earlier this year, it was reported that British social media users had lost £214 million in financial scams over the previous five years. Facebook reported the highest figures, however, TikTok scams are growing fastest and fake celebrity endorsements are also rife.

Social media is helpful for companies to engage with their clients, but be sure to visit their official website and do your research before making any financial decisions.

Keeping the above in mind will reduce your chances of falling victim to scammers. Be alert!

Protect yourself this Christmas and beyond

Scammers are becoming increasingly sophisticated, and no one is immune. By following these six steps, you can help to reduce your risk and protect your personal and financial information.

If you’re unsure about any financial offer or need guidance on keeping your finances secure, speak to your financial adviser. We can help you make informed decisions and give you the confidence that your money and personal information are safe.