Every day seems to bring more news about challenges in the economy with negative impacts on financial markets. What does this mean for your pensions and investments and what should you do about it?

What’s happening?

Markets are currently reacting to multiple challenges:

- The aftermath of the pandemic

- The impact of the Ukraine war

- Supply chain constraints

- Rising inflation

- Rising interest rates

- Changes in Government – more than once!

All of this has resulted in increased volatility and falling valuations. But is this something to worry about? As always, that depends on your viewpoint. The more of a short-term view that you have, the more important it will be.

Long-term thinking

Taking the long view can help put short term movements in perspective. Moreover, if you are investing regularly through your pension/investment then you will benefit from pound cost averaging – you will be buying more units for your money each month. This means that when the markets recover, and the units rise in value, your pension and investment value will also rise.

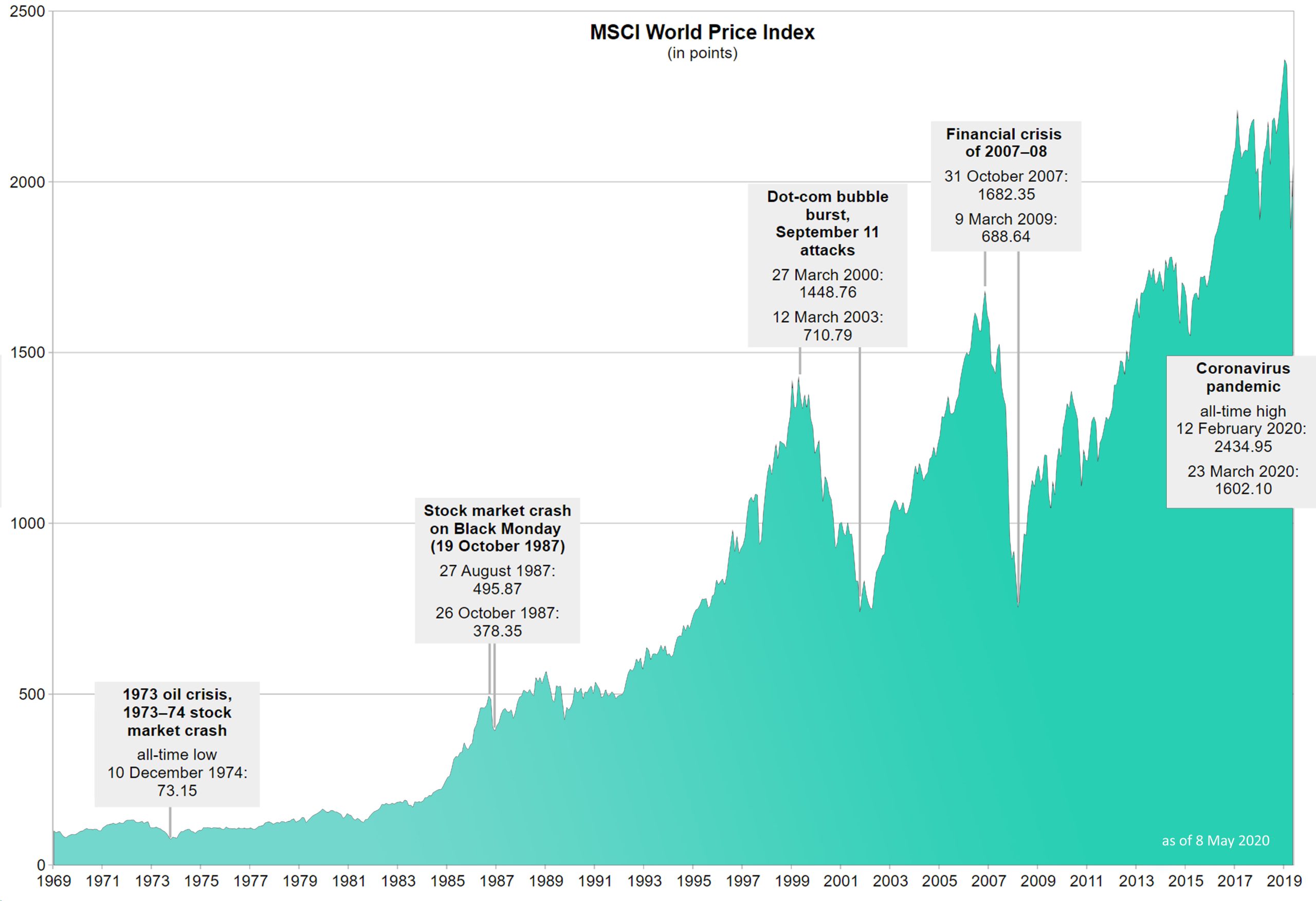

Whilst we can’t predict what will happen in the future, it is helpful to look at how markets have recovered in the past after downturns. The graph below illustrates the history of market fall and recovery over the years.

Short-term thinking

It is of course very worrying to watch your current pension and investment values fall and you may be considering changing how your funds are invested or even thinking about cashing them all in.

But please, pause and consider your position: selling now, when the markets have already fallen will mean that any recent losses are secured. It is important to remember your pension or investments are for the longer term. This may help you feel more able to weather the more volatile times. Research shows that those who stay invested over the long run in a well-diversified set of funds will generally do better than those trying to time the market.

What should you do now?

Firstly, consider your individual circumstances. You might be some way from retirement, about to access your pension or investment for the first time, or already drawing an income from your pension/investment plan. But the principle of ‘don’t panic’ applies in each of these scenarios. The following articles from Vanguard and Aviva may be helpful in considering your position further

The dos and don’ts of investing in a downturn

Retired or retiring soon and worried about falling markets?

How to keep calm when stock markets fluctuate – Aviva

Secondly, it is best not to make any sudden decisions but speak to your financial adviser first.

MAC Sponsors IOM CoC Positive Health & Wellbeing Conference

The Positive Health & Workplace Wellbeing Conference takes place on 26 November, with MAC sponsoring the leadership breakfast.

MAC Group Sponsors Isle of Man Team in 2024 Small States of Europe Badminton Championships

MAC Group Sponsors Isle of Man Team in 2024 Small States of Europe Badminton Championships

Mike Stringer Promoted to Senior Group Risk Consultant

MAC Financial is pleased to announce the promotion of Mike Stringer to Senior Group Risk Consultant.

MAC Group Golf Day raises £6,000 for charity

MAC Group Golf Day raises £6,000 for charity MAC Group is thrilled to announce that our Charity Golf Day, held on 13 September 2024 at Ramsey Golf Club, raised an impressive £6,000. This significant amount was generated through entry fees, a...

Trainee Paraplanner Todd Crellin Earns CII Regulated Diploma

Trainee Paraplanner Todd Crellin Achieves Chartered Insurance Institute (CII) Regulated Diploma at MAC Financial MAC Group is proud to announce that Todd Crellin, one of MAC Financial’s Trainee Paraplanners, has successfully passed the Chartered...

MAC Group Sponsors “We Will Rock You”

MAC Group Sponsors “We Will Rock You” The Isle of Man rocked this summer, thanks to the support of MAC Group! Nearly 7,000 people have attended the Taylorian production of “We Will Rock You” at the Gaiety Theatre, where MAC Group proudly sponsored...

MAC Charity Golf Day 2024

MAC Group is excited to announce its upcoming charity golf day, set to take place on Friday, September 13th, at the prestigious Ramsey Golf Club.

Minimum wage increase 2024

With effect from 1 July 2024, the ‘interim‘ new minimum wage will increase. Rebecca Netten, Head of Corporate Advisory shares the impact upon pension schemes.

MAC sponsors Isle of Man Youth & Junior Cycling Tour

MAC Group, the Isle of Man’s largest independent financial advisory and insurance broking group, is proud to announce the sponsorship of the first stage of the Isle of Man Youth & Junior Cycling Tour 2024.